Credit card balances with high-interest are the problem you do not want to affect your household finances, but sadly, they do.

Getting rid of your credit card debt can be really tricky, and it could take quite a long time, if not managed properly. And getting rid of credit cards with high-interest rates solves the problem where so much of your monthly payments go to paying interest.

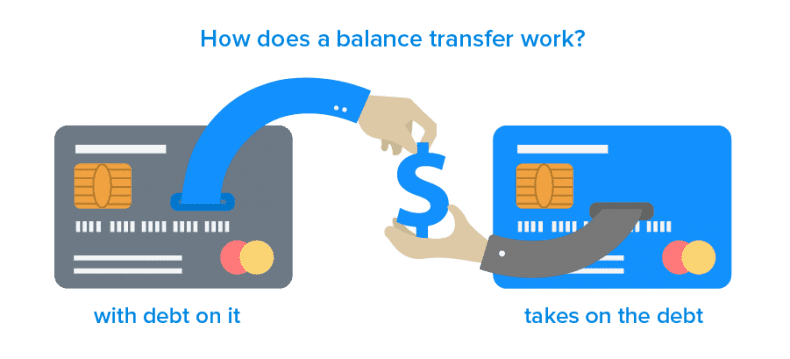

One way of getting rid of this problem is though balance-transfer credit cards. This method works in a way that you move one or more high-interest balances onto a single credit card that charges low interest.

If interested in this method, then you can find the answers to questions mostly related to balance-transfer credit cards.

1. Can I still get a balance transfer credit card, even if I have a bad credit score?

Usually, people with good to excellent credit stability are offered 0% interest credit cards. If you don’t fall into this category, meaning your credit is lacking, then some card issuers will allow you to add a friend or family member as a co-signer. One condition is that the member in question must have better credit.

2. Can I transfer multiple balances on the one balance-transfer credit card?

If the sum of your balance doesn’t exceed your transfer limit, then you can add more balances to the balance-transfer credit card. Of course, you might get a cap on the number of transferable balances, and you can’t transfer a balance from one card to another card by the same issuer.

3. Will I get a limit high enough to the balance-transfer credit card in order to cover the whole amount I wish to transfer?

The amount of your credit card transfer limit is disclosed until you are approved for the card. Upon approval, you can request for a higher credit card line, and if that’s approved as well, then you can start to pay off your other balances.

If you are denied for a high credit line, then consider applying for a low-interest loan in order to loosen your debt.

Another substitute for a balance transfer credit card with a high line is equity credit. This is viable if you are a homeowner and serves as an option to paying off balances. If opting for this method, be aware as if you fail to repay the loan, your house will be at risk of repossession.

4. How does a balance-transfer affect my credit score?

Experts point out that opening a new balance-transfer credit card affects your overall credit score in a few ways.

- The longer you’ve had your credit accounts, the better it affects your credit card score. Opening a new credit card will shorten the overall age of your credit accounts, since the average age of all credit accounts is considered, and it will have an impact on your credit score

- Avoiding to open new credit cards will be beneficial for your credit score

- Paying your debt will increase your credit score, making more room to apply for a new credit

In order to maintain a low or no-interest credit card balance-transfer, you need to follow these simple steps.

- Keeping your old credit cards open will benefit your credit score. Although you should keep the balance at zero in order to avoid the balance-transfer debt cycle

- Always keep in mind the transfer fees for balance moving.

- Missing a payment, during a 0% interest rate, will only lead to the issuer canceling your deal, or increase the interest rate

- Avoiding to spend any money with your new card will help maintain the interest rate at 0%