The stock price of Herbalife Ltd. (NYSE:HLF) dropped more than 7% to $60.57 per share after its disclosure that the Federal Trade Commission (FTC) launched a civil investigation against it.

The trading of the shares of Herbalife Ltd. (NYSE:HLF) and the stock of Nu Skin Enterprises, Inc. (NYSE:NUS) were temporarily stopped at around 1:18 in the afternoon, Eastern Time to announce the action of the regulator.

The multilevel marketing (MLM) company selling nutritional and weight loss supplements has been the center of controversy since activist invest investor, Bill Ackman of Pershing Square Capital Management alleged that it is a pyramid scheme.

Ackman’s new presentation on Herbalife China

Prior to the inquiry of the FTC, Bill Ackman and the management of Herbalife Ltd. (NYSE:HLF) exchanged sharp comments. Yesterday, the activist investor gave a new presentation that the business practices of the company violate regulations in China based on result of the investigation of OTG Research, which was hired by Pershing Square. Ackman said Herbalife’s “hourly consulting pay” is the key to prove that it breaks China’s laws because its distributors are paid based on the number of their recruits.

In response to Ackman’s presentation, Herbalife Ltd. (NYSE:HLF) expressed confidence with its business in China and emphasized that it is built on customers benefiting from and enjoying its products. The company said it will continue to invest in China and to collaborate with the Chinese government to deliver high-quality nutrition to consumers in the country through lawful direct selling practices.

Herbalife Ltd. (NYSE:HLF) added, “The presentation reflects Mr. Ackman’s continued failure to fundamentally understand Herbalife’s business model.”

Herbalife welcomes FTC inquiry

With regard to FTC’s civil investigation, Herbalife Ltd. (NYSE:HLF) stated that it “welcomes the inquiry given the tremendous amount of misinformation in the marketplace.” The company also said that it will “cooperate fully” with the regulator.

“We are confident that Herbalife is in compliance with all applicable laws and regulations. Herbalife is a financially strong and successful company, having created meaningful value for shareholders, significant opportunities for distributors and positively impacted the lives and health of its consumers for over 34 years,” added Herbalife Ltd. (NYSE:HLF).

Equity risk

Given the FTC investigation, it is reasonable to say that shares of Herbalife Ltd. (NYSE:HLF) would be volatile or at risk over the next few days or even weeks/months not until the regulator clears the company from wrong doing. Take note that, there are also requests to the office of attorneys generals in various states across the country to look into the business practices of the company.

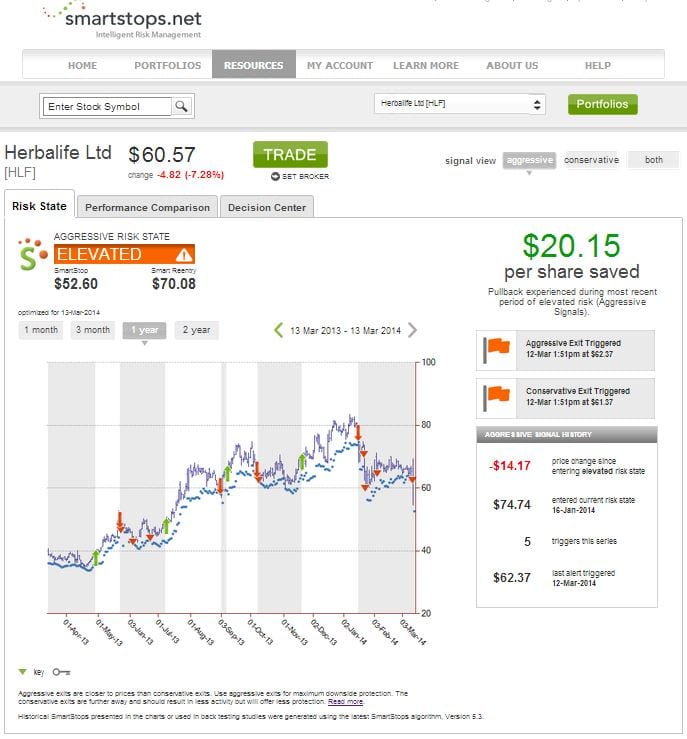

Smasrtstops.net, an equity risk management firm immediately released a risk alert to its subscribers regarding the stock. The firm shows that Herbalife Ltd. (NYSE:HLF) is current at elevated risk. Investors who pulled back their investment on the stock when it entered its current risk state saved $20.15 per share as illustrated above.