Money has changed a lot over the period of 5,000 years. Before money was around, people used to barter for objects they desired, while in modern times people use cryptocurrencies like bitcoin to buy and trade.

In prehistoric times people didn’t use money to buy and sell. Since they didn’t have money, they had to trade things they owned for what they wanted or needed. This was called bartering. This was a very good system at the time, but as time went on and humans and society evolved there was a need for a better and more table system of trading. A lot of countries at that time started using money, whose value was deemed by the material it was made from. This kind of money is called “specie money” and its value is set by whichever metal it is made from.

At the start coins were made from copper and a bit after that from iron; these were materials which were also used to make weapons. Again, the financial value of different currencies was set by the value of the metal they were made from. Coins became a very good way of buying and selling, because you could count coins, there was no need for weighing. Coins became more and more trusted, because people saw how they were increasing sales and making trade better everywhere.

The first coin known to man and history was used around 3000 BC in Mesopotamia and people called them shekel or siglos. The shekel was a prehistoric way of setting value and weight of whatever was going to be traded and how much of the material used to buy that should used, material like copper and bronze. Making money a staple in society was incredibly important and it was even written into Hammurabi’s law code created around 1760 BC. The Mesopotamians were responsible for creating a civilization that used money on a large scale and thus creating an economy based on money. Mesopotamians aren’t the only ones who were using money though, their neighbours, the Babylonians and other nearby states developed some of the first economic systems that are similar to the ones we use today. They developed things like how debt should be handled, contracts being extremely important and they made laws people have to follow when conducting business and when dealing with private property.

Some time after that, and a bit farther away from Mesopotamia, the Greeks, specifically king Pheidon in 700 BC was the first person to have started using a specific set of standards for weight and money and started making coins from a metal that didn’t really have any value like iron or copper did, it was silver. He was making coins in Aegina, a temple made for the goddess Athena, they were coins they turtles on them, which later on became a symbol of capitalism. Money that turtles on them became something that could be used internationally and was used everywhere until the Peloponnesian War, after which that currency was stopped being used and the drachma, which came from Athena, replaced them.

Now, after a long time of using just coins and metal in general for buying and selling, it was time for another change, a change for the better. The first paper money or banknotes were first developed and started being used in China, where the Song Dynasty was ruling at the time, between 600 and 1455. To be specific. This paper money or banknotes were called Jiaozi and had been in use since 600 AD, while in Europe the first time anyone started using paper money was in Stockholm, it was issued by Stockholms Banco in 1661 and was still being used with coins together. It didn’t really go well, because the bank kept running out of coins to pay for the same amount of banknotes, so in the end it had to be stopped. But as we all know, we use paper money today, so that was no end of it. In the 1690s, the Massachusetts Bay Colony started printing paper money and it became a much more commonly used thing there.

From all that stemmed today’s monetary system. It went from bartering to the use of coins and when coins became a bother, paper money was there to replace them. As transactions become something done mostly with paper money, governments became much less concerned with paper money to precious metals rations. Paper money now had nothing to do with precious metals and became something governments had to supply. But even today you could say that paper isn’t really the true currency, because most of today’s money is digital, actually around 90% percent is digital.

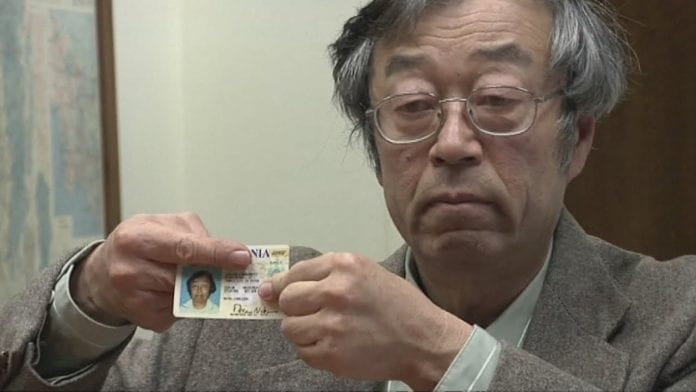

The fact that so much money is digital today is very important, because it led to the birth of something completely new in 2009. A person using the name of Satoshi Nakamoto introduced something, a document that presented a thing called Bitcoin and there were a couple of things that defined it.

It was decentralized, which meant there is no central authority so it solely depended on the people who were using that currency and not some government.

It was trustless; which meant that there was no need for trust, the currency came with a guarantee of accuracy and integrity, while normal paper money is founded on trust, for instance you have to trust that your bank will secure your money.

It was peer-to-peer, which meant that there was no middle-man, or no one to manage the exchange of money, you could do it directly between two entities.

All this was actually invented in 1997 by Adam Back and was called Hashcash, but Nakamoto used that system and adapted to today’s needs.

Why is bitcoin important? The real value in bitcoin is what it brings to the table, not its value, but the fact that it’s trustless, peer-to-peer and decentralized, which people often forget. When you really look into bitcoin you can see how much potential it has and that it can be the next big change, like how bartering went to coins and coins went to paper money. The next big change could be that governments won’t participate in the circulation of currency.

If you want to learn more about how bitcoins works you should visit bitcointalkshow.com.