Cryptocurrency markets have expanded far beyond Bitcoin (BTC) and Ethereum (ETH). The market broadly encompasses dozens of altcoins, utility tokens of dApps, DeFi protocols, and more. As the cryptocurrency market is yet at a relatively nascent stage as compared to other investment markets, it does hold a degree of risks. At the same time, because the market is in the developmental framework it presents unprecedented opportunities for investments.

A diversified cryptocurrency portfolio is one of the tools that facilitates a trader to minimize the exposure to risks owing to market swings whilst maximizing the opportunities for profits. In this article, we seek to understand why it is important for a trader to have a diversified cryptocurrency investment portfolio and also how to build a cryptocurrency portfolio that mitigates risks as well as maximizes investment profits.

What is a Diversified Cryptocurrency Portfolio?

A diversified cryptocurrency portfolio refers to the act of investing in multiple tokens to lower the risk of losses in the event that one or more investments fail to perform. Whilst institutional investors have always sought to diversify their investments in conventional markets of forex, stocks, and bonds, diversification plays a key role in the cryptocurrency markets.

Cryptocurrency markets are volatile. The sudden boom or burst is not very uncommon. Moreover, if employed correct methods, volatility in prices may work to a trader’s advantage. A diversified cryptocurrency portfolio plays an integral part to help mitigate the risks of volatility along with using it to a trader’s advantage.

Why Diversify Cryptocurrency?

The cryptocurrency space is rapidly developing with new projects and their subsequent tokens released every day. However, it is also quite common for projects to turn into scams or be forced to stop operations due to regulation uncertainty, hacks, etc. A diversified portfolio helps mitigate such risks in the case of failure of such projects.

Additionally, altcoins and tokens present a huge opportunity for accessing exponential growth in a very short span of time. The primary reason is that as projects are in development phase, their tokens are offered at a discounted rate. If any one or more tokens in your portfolio attain massive success, it increases your chances of hitting a jackpot and minimizing losses from failed projects.

Crypto Portfolio Diversification Strategies

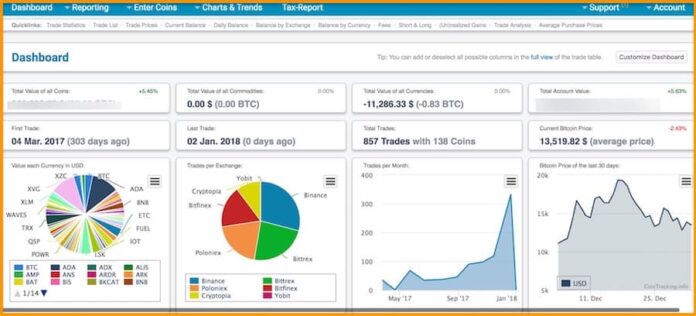

There are more than one ways to diversify your cryptocurrency portfolio depending upon a multitude of factors including your interest, investment amount, location, etc. We have explored one of the strategies that can help you build a diversified portfolio taking into account the properties of cryptocurrency tokens.

1. Diversification Based on Industrial Use-Cases

The blockchain ecosystem encompasses use-cases in multiple industries including healthcare, supply chain, finance, banking, real estate, online gaming, etc. Decentralized applications built on blockchain in these industries generally incorporate a utility token. These altcoins or tokens hold unprecedented potential as their project succeeds and valuation increases.

For instance, Propy (PRO), a token with use-case in real estate provided returns of almost 50% in the year 2024. An investment of $1 in PRO in January 2024 would be worth more than $1.4 in November 2024. Augur (REP) is a token facilitating prediction market industries that has yielded more than 30% returns from the period of January to November 2024. For more information about Augur (REP), click here.

2. Diversification on Solutions

The next part of your cryptocurrency portfolio can be investments derived on solutions, new protocols, or service providers in the cryptocurrency markets. This allows disbursement of risks and capturing growth in the event that an entire segment achieves high growth.

The DeFi industry is one of the sector solutions which has achieved substantial growth in 2024. DeFi protocols have attained as much as 600% in the year 2024 alone. The industry has grown from less than $1 billion in February 2024 to nearly $13 billion locked in November 2024. Learn more about why DeFi is so important by reading this Forbes article.

3. Cryptocurrency Property

Your diversified cryptocurrency portfolio may include a variety of coins based on their inherent properties. Cryptocurrencies are segregated based on properties like privacy, stablecoin, staking coins, etc. It is a possibility that coins based on their inherent properties are likely to have a higher valuation in the next few years.

For instance, privacy coins like Monero (XMR) are considered to hold a huge potential in the near future. Stablecoin investments like Tether (USDT) protect investors against volatility in cryptocurrency markets. You can also choose to invest in cryptocurrency tokens that facilitate a yearly staking reward simply by holding in wallets. This facilitates an investor to earn passive income by holding tokens.

Conclusive Remarks

The cryptocurrency industry has moved substantially well beyond Bitcoin and Ethereum. This segment of cryptocurrency markets hold unprecedented growth but at the same time are more susceptible to risks. However, a diversified cryptocurrency portfolio can be established as a key tool that helps in managing the risk factors. At the same time, it also provides access for investors to leverage the untouched potential of cryptocurrency markets.